OVERVIEW

Neuro-Kinesis, Corp. (NKC) is a medical technology company focused on creating next-generation surgical tools incorporating advanced biosensor systems that can provide real-time biofeedback of a variety of process-critical data to a physician or surgeon where the monitoring of precise environmental status points can greatly enhance a patient’s procedural outcome.

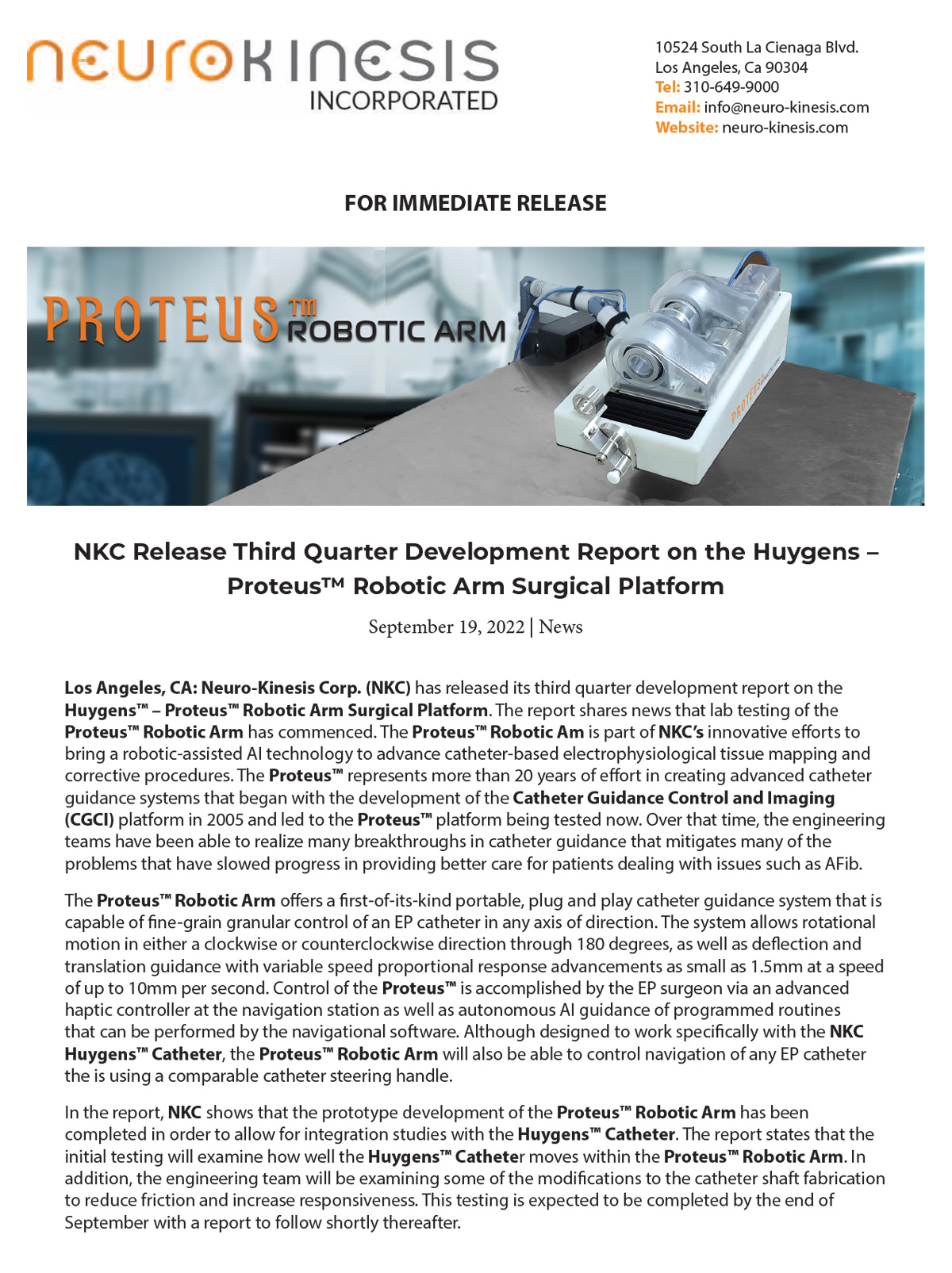

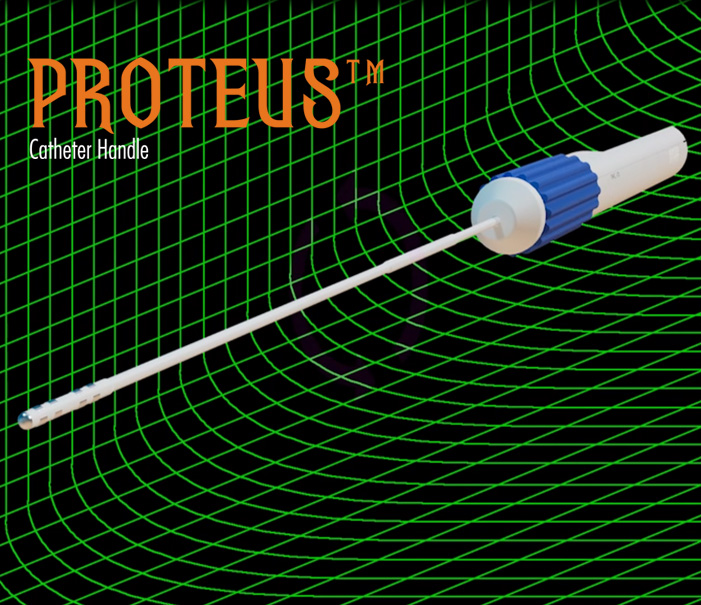

In the medical surgery arena, NKC has developed two initial product candidates that will fundamentally change how surgeons and physicians in the electrophysiology field approach procedures. The first is the Huygens™ Catheter which is a revolutionary new tool for providing next-gen catheter-based imaging and mapping for patients suffering from heart conditions such as aFib where precision mapping is needed for life-saving ablation or in patients needing renal denervation for the treatment of hypertension. The second technology is the Proteus Robotic Arm™. The Proteus Robotic Arm™ provides a fully automated catheter guidance system using cutting-edge AI and proprietary control systems that can move a catheter with precision control over three axes of direction and deflection within the dynamic moving environment of a human organ, such as a beating heart. When combined, The Huygens™ Catheter and the Proteus Robotic Arm™, along with the NKC Intelligent Catheter Mapping and Guidance System create a groundbreaking approach to SMART catheter-based electrophysiology procedures that give the treating surgeon a whole new level of control and cure for their patients.

WEBSITE: Neuro-Kinesis.com

EMAIL: info@neuro-kinesis.com

TEL: +1-310-641-2700

ADDRESS:

10624 S La Cienega Blvd.

Inglewood, CA 90304

USA

KEY HIGHLIGHTS

The Huygens™ Catheter

-

- The first Electrophysiology (EP) catheter to bring all the processing of bio-detection and processing into a micro-miniaturized control system contained in the catheter tip.

- This proximal-end processing translates to a 200x increase in signal fidelity and image resolution.

- Nine active mapping electrodes in the tip provide a dramatic increase in field sampling of bioelectric signals necessary for accurate tissue mapping.

- Advanced signal processing allows for enhanced bio-based energetic events capture by relating the inherent characteristics of time, magnitude, and direction into correlated data points that are used to create a high-resolution map.

- All processing including, signal amplification, analog to digital signal conversion, noise reduction processing, far-field signal elimination, and data computation are managed here before being sent by optical fiber back to the mapping station.

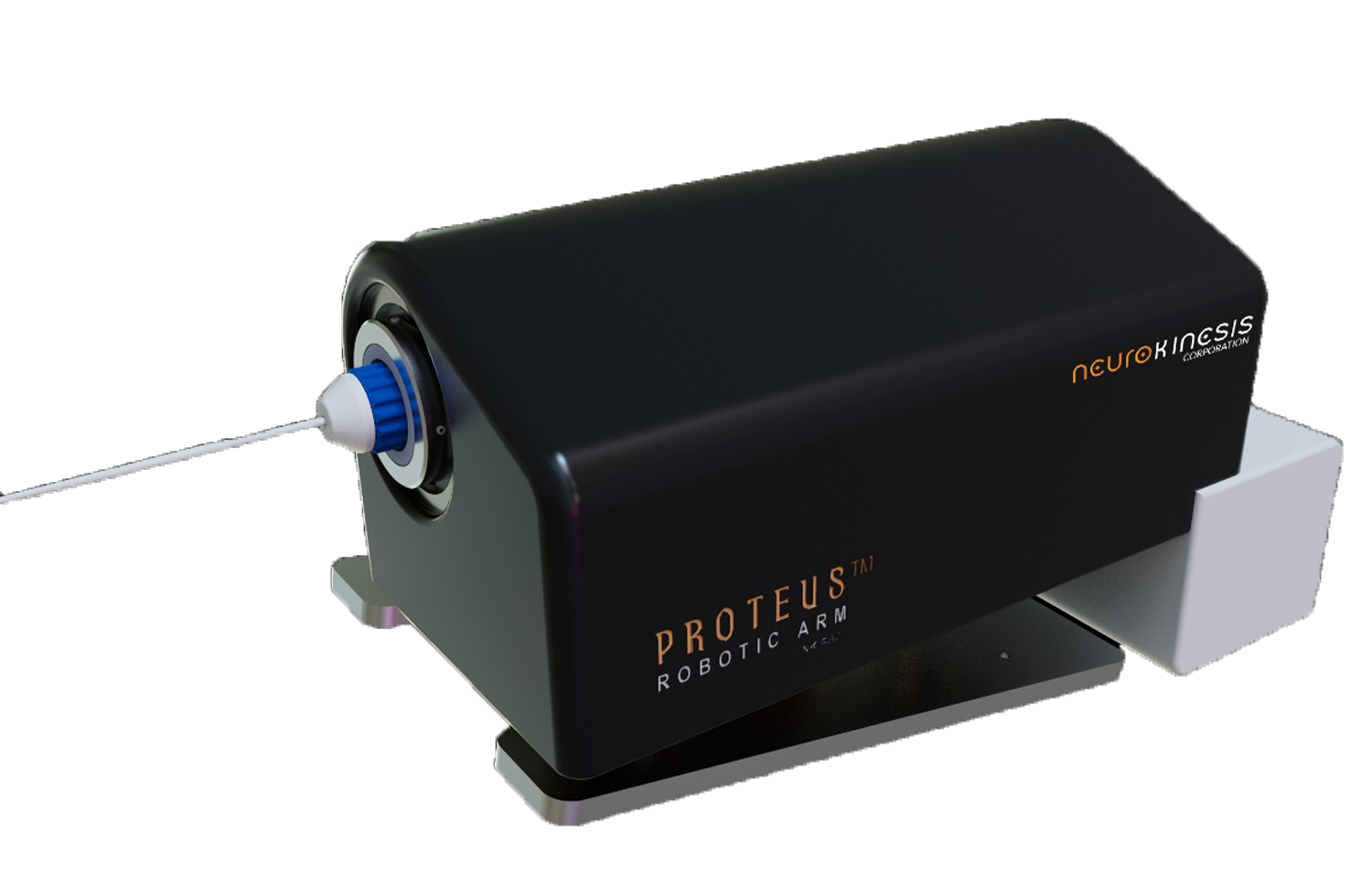

The Proteus Robotic Arm™

-

-

- A portable bench-top technology that brings robotic-assisted guidance to catheter navigation inside the dynamic environment of the human body.

- Precision control of a catheter to a ± 2mm degree of movement.

- Complete directional control on 3 degrees of the axis as well as 360° of deflection rotation.

- Ability to execute a pre-programmed path of navigation based on EP surgeon’s generated ablation point mapping at the touch of a button.

- The Proteus Catheter Handle™ can be used with any standard EP catheter to bring the precision control of the Proteus to its operation.

- The Proteus Catheter Handle™ can also be used manually as a standard catheter navigation handle.

- Control of the system is handled by the NKC Intelligent Catheter Mapping and Guidance System.

- A Haptic Control device allows the surgeon dynamic control of the catheter movement with force-feedback signaling responsive to tissue density.

-

INVESTMENT OVERVIEW

By packaging this startup equity investment within a proven revenue-generating program at PFD Management Opportunity Fund 3001, LLC (PFDMOF3001).

The investor receives:

- 5% annually on invested capital, distributed on a quarterly basis.

- 165% of invested capital back at the end of year 5 ($1.00 gets $1.65 at term)

The internal rate of return is 18% annually

- 5% annually for 5 years is 25%

- 165% at term is an additional 13% annually for 18% IRR

The investor has little else to be concerned with should the exit of this project take longer to exit, or the projected valuation varier from initial projections.

- Upon exit of this portfolio company, the fund will distribute the net proceeds to fund members proportional to their ownership in the fund.

Projected additional equity return:

- The targeted additional return is estimated for a 112% one-time distribution.

people are estimated to be diagnosed with Atrial Fibrillation by 2030 requiring an ablation procedure to correct the issue.

https://www.cdc.gov/heartdisease/atrial_fibrillation.htm

PRESENTATION

The NKC Huygens™ Catheter and the Proteus™ Robotic Arm along with the NKC Intelligent Catheter Mapping and Guidance System represent a significant breakthrough in providing Electrophysiology physicians a toolkit that will bring new levels of diagnostic control and information that will enhance their ability to bring a cure to their patients while at the same time saving much of the costs associated with competitive alternatives.

TAKE A LOOK AT THIS PRESENTATION TO SEE WHY THE NKC SMART CATHETER AND ROBOTIC-ASSISTED GUIDANCE SYSTEM WILL HAVE A FUNDAMENTAL POSITIVE IMPACT ON THE ENTIRE FIELD OF ELECTROPHYSIOLOGY

PAIN POINT

Reinventing The Map

The science and art of Electrophysiology have not seen much of a change in the past fifty years. At the core, a surgeon must still push a thin wire by hand into a patient’s body to create a map of their heart to determine where the roadblocks are that are keeping the heart’s electrical signals from getting from point A to point B.

An Accurate Map IS The Key To Achieving Effective Cure

Measuring the electrical biopotential has always been the choke point in heart mapping because the voltages are so small that detecting desired signals from the sea of electrical noise in a hospital room is daunting. It is like trying to map a location to find the road from the ditches, the rocks, and trees that have fallen, while in a fog as the sun is going down, from an aircraft 10,000 feet above the ground using a pair of binoculars.

How Do You See The Forest From The Trees?

But what if the detection equipment was on the ground, with fog lamps and infrared radar? Now the map becomes something that can better guide the traveler.

This is what the NKC has done. By first creating a mapping system capable of separating the important bio-signals from the noise with 200x more fidelity to create an unprecedented leap in the quality of the map the surgeon has to work with; and then giving him a GPS system that will remember where they have been, where they want to go, and how to get there; all with the push of a button.

The NKC Huygens™ Catheter and the Proteus™ Robotic Arm along with the NKC Intelligent Catheter Mapping and Guidance System bring EP Navigation into the next century…

…and BEYOND

Electrophysiology is a $4.5B dollar market that is anticipated to grow at over 12.4% CAGR between 2021 and 2027.

ELEVATOR PITCH

- A first-mover breakthrough in mapping catheter technology that has NO competition.

- A technology capable of increasing the fidelity of EP mapping by 200x.

- A technology that moves a room full of equipment onto a flexible micro-circuit board located at the tip of the catheter to eliminate the signal-to-noise issues that have plagued the EP field for decades.

- A disposable consumable market of $450B and growing

- An intelligent robotic-assisted guidance system that fully integrates the catheter, the surgeon, and the map into a synchronistic navigation ability.

- A price point for a complete technology package that is far lower than any of the competition on the market today.

ADDRESSING THE MARKET

The current Electrophysiology market is $5B and is expected to reach $10.6 billion by 2025 growing at a CAGR of 9.1% from 2020 to 2025(1).

- Atrial Fibrillation (AF) is the most common issue diagnosed in clinical practices accounting for 6.1 million people in 2018. This is estimated to rise to 12.1 million by 2030.

- Global ablation procedure numbers are predicted to grow from 973,220 in 2017 to 1,455,000 per year by 2022; within this category, complex ablations (AF and VT) are expected to increase by 13.5% annually from 440,629 in 2017 to 830,390 in 2022

- Currently, the electrophysiology market is extremely competitive in terms of pricing because of the premium cost associated with products such as cardiac 3D mapping systems, EP recording systems, and the emerging robotic-navigation systems.

- Emerging markets are expected to offer significant growth opportunities for players in the cardiac mapping systems market, mainly due to their increasing patient population, rising adoption of cardiac mapping systems, growing awareness of CVDs, rising disposable incomes, improving healthcare infrastructure, and comparatively lenient guidelines as compared to developed countries.

NKC is poised to be able to make a significant impact in this market based on its key differentials:

-

- The Proteus Robotic Arm™ offers an option in the growing robotic guidance sector of EP that not only exceeds the capabilities of existing systems but does so at an entry point cost that is substantively lower than any technology currently on the market.

- The Huygens™ Catheter provides the ability to bring a 200x increase in 3D mapping fidelity that will not require any additional dedicated hardware costs.

The Timing and Technology Advance that NKC Brings, May Be A Key Disruptor In The EP Market

Adults in the US have diagnosed hypertension for which renal denervation could have a beneficial impact on regulation or cure.

https://www.cdc.gov/bloodpressure/facts.htm

INTELLECTUAL PROPERTY

PATENTS

NKC has established and continues to pursue a vigorous program of IP protection through the aggressive acquisition of trademark and patent certification. NKC currently holds more than 38 patents related to its catheter technology development and 74 patents for its robotic guidance system.

HARDWARE

NKC’s technology development has resulted in the creation of several new novel developments in the areas of biological signal detection, signal amplification, noise reduction, analog to digital translation of biologic signals, micro-electric miniaturization, electrode sensing, mechanical drive systems, and optical signal transfer. All of these unique system achievements set NKC in a solid position of high IP viability distinction from existing and future competition.

SOFTWARE

Complimenting NKC’s hardware development is its strides in developing the software which allows all the components of the system to talk and communicate with each other. This includes the unique algorithms processing for signal interpretation, high-resolution 3D mapping software, omni-directional navigation control, firmware, and GUI systems, and cloud connectivity communication and storage systems.

SCALABLE BUSINESS MODEL

NKC has set a strategic path for the growth and positioning of its Huygens™ Catheter and the Proteus™ Robotic Arm along with its NKC Intelligent Catheter Mapping and Guidance System technology. The company has finalized its initial proof-of-concept and prototyping phase and is entering into its first clinical trials. Set to complete the initial trials by the third quarter of 2022, the company will then use the data it has gathered to complete its initial regulatory requirements and present the technology for its CE certification. It is anticipated the CE Mark certification will be obtained by the end of the fourth quarter of 2022 at which point the company will be allowed to begin commercialization in the EU.

At this point, NKC will begin its human trial testing for the next phase of regulatory and commercialization purposes. The company plans to perform independent auditing to determine its market valuation once these benchmarks have been achieved. Based on the results, NKC for its exit point; will then begin to consider offers to purchase the technology from the large medical-technology players in this space.

Purchase of the technology from companies such as Medtronic or Johnson and Johnson; will enable the technology to be scaled and marketed to the consumer space on a global scale. These companies have the infrastructure and experience to move the technology into a viable and accepted option for broad-spectrum use in the Electrophysiology field.

Biosensor Electrodes

Signal-to-Noise Filtering

Lab-On-A-Chip

Fiber-Optic-Data-Transmission

Complete Positioning Control

Guidance System and EP Catheter Integration

COMPETITIVE LANDSCAPE

NKC’s Huygens™ Catheter and the Proteus Robotic Arm along with the NKC Intelligent Catheter Mapping and Guidance System technologies are creating a very dynamic and disruptive breakthrough in the field of Electrophysiology. Its Huygens™ Catheter has NO competition in its space and its projected price point will make it highly competitive with even the existing “Dumb” catheter products currently in use.

The Proteus Robotic Arm™ does have several competitors in its space, but as the information below shows, none of the systems provide the portability, integration with mapping and guidance software, and price-point advantages the system brings to the market.

Manual Catheter Navigation

PROS

- Known process and technology

- Accepted method in both education, practice, public acceptance.

- Material cost is relatively low.

- Availability of a wide array of EP catheter tip applications available.

CONS

- Navigation is entirely dependent on the skill and condition of the surgeon.

- No ability to provide exact return-to-point navigation.

- Precision to move catheter systematically for mapping to provide complete grid analysis of the environment is greatly limited.

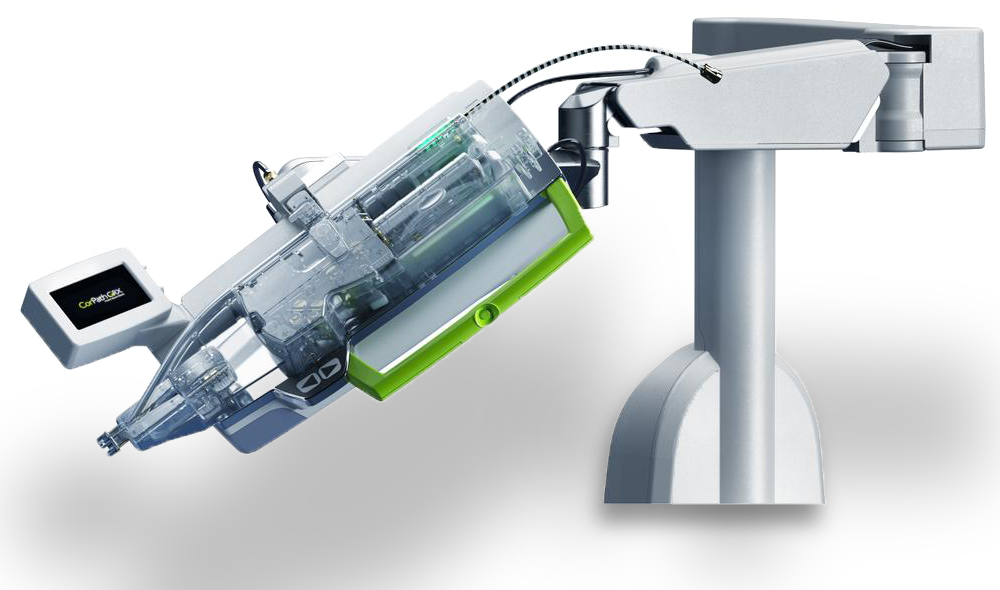

Corindus CorPath GRX

PROS

- Mechanical system provides directional navigation of a standard catheter.

- Ability to decrease procedure time by up to 20%.

CONS

- High cost for a unit at $480,000

- Price does not include installation and operating suite infrastructure upgrade cost which could double the price.

- System has not automatic navigation capabilities.

- No current ability to interface with an imaging system.

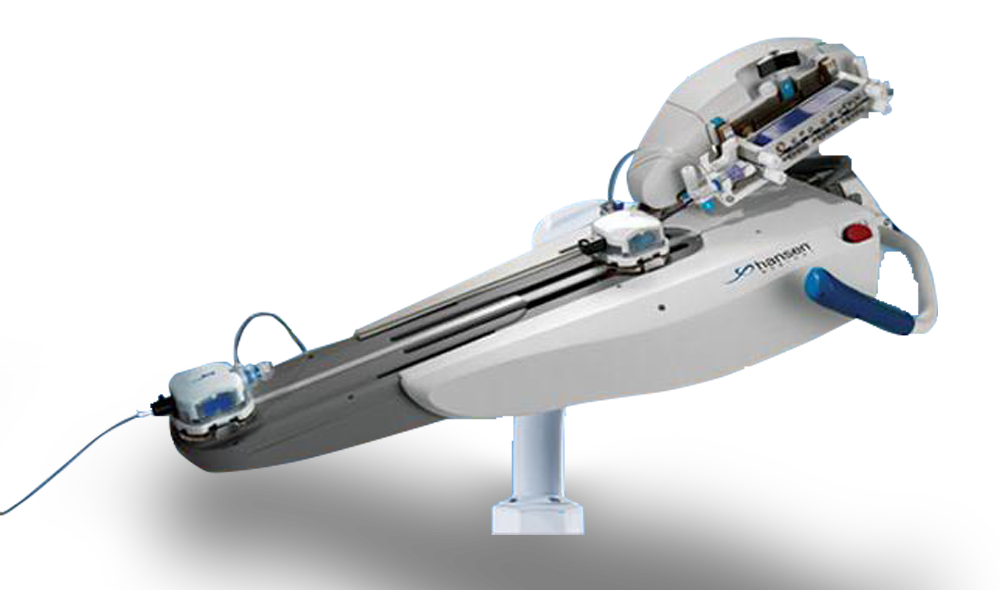

Hansen Magellan Robotic System

PROS

-

- Mechanical system provides directional navigation of a standard catheter.

- Ability to decrease procedure time.

CONS

-

- High cost for a unit at $600,000

- Price does not include installation and operating suite infrastructure upgrade cost which can dramatically increase up-front investment cost.

- Maintenance costs for the system can run up to $80,000.

- System has no automatic navigation capabilities.

- No current ability to interface with an imaging system.

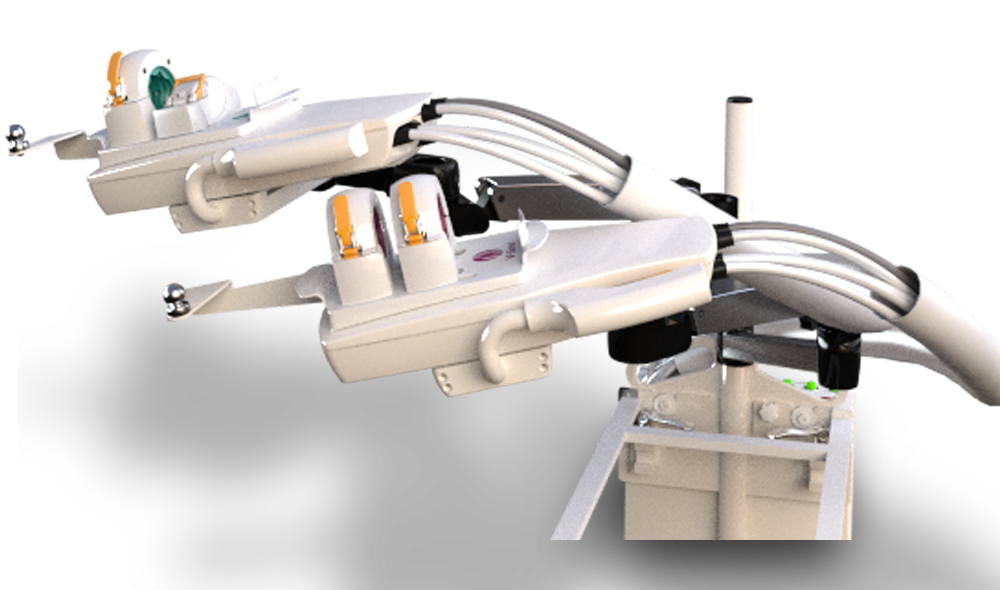

CRI Amigo RCS

PROS

- Mechanical system provides directional navigation of a standard catheter.

- Low learning curve rate compared to other systems.

- 95%+ efficacy in hitting targeted area.

- High compatibility with existing monitors and workstations.

CONS

- High cost for a unit at $XXX

- Price does not include installation which can increase upfront investment cost.

- System has no automatic navigation capabilities.

- No current ability to interface with an imaging system.

Stereotaxis VDrive

PROS

- Mechanical system provides directional navigation of a standard catheter.

- Ability to decrease procedure time by up to 20%.

CONS

- High cost for a unit at $480,000

- Price does not include installation and operating suite infrastructure upgrade cost which could double the price.

- System has no automatic navigation capabilities.

- No current ability to interface with an imaging system.

SKILLED LEADERSHIP TEAM

NKC was founded in 2016 to capitalize on the work of Josh Shachar and his engineering team in their more than a decade and a half of research and development efforts in developing advanced robotic-assisted catheter navigation systems and cutting-edge biosensor technologies. The NKC Executive Management team is comprised of leading individuals in business startup and growth as well as accredited physicians in the electrophysiology and neuroscience fields.

EXECUTIVE MANAGEMENT TEAM

Josh Shachar

Board Chairman,

Chief Executive Officer

and

Chief Technology Officer

Frank Adell

Director and Chief Investment Officer

Roger Kornberg, PhD

Chairman Science Advisory Board

2006 Nobel Laureate in Chemistry

Thomas Chen, MD, PhD

Director and Chief Neurology Officer

Eli Gang, MD

Director and Chief Medical Officer

Eustaquio Abay, MD, FACS

Director

Randy Wear

Advisor

RISK FACTORS

The following is not an exhaustive list of risk factors that may impact the PFDMOF3001 and or this particular portfolio company’s ability to fulfill its goals and/or negatively impact stakeholder value.

In evaluating the PFDMOF3001, the Company itself, and the portfolio company described within these pages and its business, the following risk factors should be considered.

Challenges of penetrating the market with new technology:

Businesses, which are often under pressure to cut costs, are often hesitant at adopting new technologies. There is a chance that NKC will have a difficult time selling large quantities of the devices and canisters.

Market Messaging:

NKC is not the only company in the robotic-assisted catheter market. This fact may prove challenging from a marketing perspective. The ability for NKC to effectively communicate its technology’s benefits to have an impact on already secured market space may be difficult and may affect its ability to gain market share.

Competition:

If another company succeeds in bypassing NKC barriers to entry (patents, technological research, and know-how), NKC may be required to lower its price to stay competitive, this will cause the company’s margins to shrink and will hurt its bottom line.

Venture Capital Speculation:

Venture capital is highly speculative and entails significant risk. Due to this, investments should not be made by investors who cannot afford to lose their entire investment. In addition, these types of securities are illiquid, and investors cannot predict when to expect a return on their investments, if any. Even an exit event for a company may only yield a partial, if any, return on investment.

Liquidity:

Investments made via our fund are generally illiquid. This means that once you have committed your money it could be difficult for you to exit your investment and get your money back at a time that suits you. There is no secondary market for your investments.

Control:

By making an investment in PFDMOF3001, you acknowledge that you are making a long-term investment. You will not have control over the day-to-day decisions made in relation to a particular investment or the timing of your exit.

Tax Issues:

You must ensure that you are aware of your tax obligations or any related risks that might apply to you as a result of any investment made by you in this fund. We encourage you to consult with appropriately qualified tax professionals regarding your tax circumstances.

Financial Risks:

Companies which are financed through venture capital may not be fully capitalized. The company may need to raise additional significant funds in the future in order to realize its business plan, which may dilute an investor’s holdings. There is no guarantee that the company will be able to secure future funds.

Execution Risk:

A company may be unsuccessful in executing its business plan for a variety of unforeseen factors. Business plans are necessarily based on a series of assumptions, some of which may not materialize as thought. Such factors include but are not limited to unforeseen challenges in research & development, unforeseen delays in securing key partnerships such as manufacturing, distribution, and marketing partners as well as delays in securing sales.

Adverse Economic Conditions:

Unfavorable changes in economic conditions, including inflation, recession, foreign currency fluctuations, political instability, or other changes in economic conditions, may have an impact on the overall investment environment for early-stage venture investments.

Management Risks:

Early-stage companies depend on a small key management team to make critical corporate decisions. Such a team may prove to be unreliable or ill-equipped for long-term corporate leadership or may simply leave for other opportunities.

Technological Risks & Defensibility:

The company’s underlying technology or intellectual property could be rendered obsolete, ineffective, or invalid by competitors or new technological breakthroughs.

Market Risks:

Even profitable companies are vulnerable to numerous external risks such as fluctuations in market trends, which could negatively impact a company’s core technology or assets, especially those companies which target a narrow sector of the market.

Regulatory & Legal Risks:

Changing regulatory and legal environments may have a significant impact on early-stage companies, complicating or outlawing key success factors. Additionally, your investment is not covered by the US FDIC or UK’s FSCS or other regulatory arrangements, nor any other statutory or voluntary compensation scheme.

Geo-Political Risks:

Early-stage companies that operate in unstable geopolitical regions may be vulnerable to events such as civil unrest, war, and sanctions.

DISCLAIMER

FORWARD-LOOKING STATEMENTS

CERTAIN INFORMATION SET FORTH IN THIS SUMMARY CONTAINS “FORWARD-LOOKING INFORMATION” UNDER APPLICABLE SECURITIES LAWS (“FORWARD-LOOKING STATEMENTS”). EXCEPT FOR STATEMENTS OF HISTORICAL FACT, INFORMATION CONTAINED HEREIN CONSTITUTES FORWARD-LOOKING STATEMENTS AND INCLUDES,

BUT IS NOT LIMITED TO, THE (I) PROJECTED PERFORMANCE OF THE COMPANY; (II) COMPLETION OF, AND THE USE OF PROCEEDS FROM, THIS FINANCING; (III) THE EXPECTED DEVELOPMENT OF THE COMPANY’S BUSINESS, PROJECTS, AND PARTNERSHIPS; (IV) EXECUTION OF THE COMPANY’S VISION AND GROWTH STRATEGY, INCLUDING WITH RESPECT TO FUTURE MARKETPLACE ADOPTION, PARTNERSHIP ACTIVITY, AND MARKET GROWTH; (V) SOURCES AND AVAILABILITY OF THIRD-PARTY FINANCING FOR THE COMPANY’S OPERATIONS; (VI) COMPLETION OF THE COMPANY’S ACTIVITIES THAT ARE CURRENTLY UNDERWAY, IN DEVELOPMENT OR OTHERWISE UNDER CONSIDERATION; (VI) RENEWAL OF THE COMPANY’S CURRENT CUSTOMER, MEMBER, PARTNERSHIP AND OTHER MATERIAL AGREEMENTS; AND (VII) FUTURE LIQUIDITY, WORKING CAPITAL, AND CAPITAL REQUIREMENTS. FORWARD-LOOKING STATEMENTS ARE PROVIDED TO ALLOW POTENTIAL INVESTORS THE OPPORTUNITY TO UNDERSTAND PFD’S BELIEFS AND OPINIONS BASED ON THE COMPANY’S BELIEFS AND OPINIONS WITH RESPECT TO THE FUTURE. THESE STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND SHOULD NOT BE RELIED ON IN ANY WAY. SUCH FORWARD-LOOKING STATEMENTS NECESSARILY INVOLVE KNOWN AND UNKNOWN RISKS AND UNCERTAINTIES, WHICH MAY CAUSE ACTUAL PERFORMANCE AND FINANCIAL RESULTS IN FUTURE PERIODS TO DIFFER MATERIALLY FROM ANY PROJECTIONS OF FUTURE PERFORMANCE OR RESULT EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. ALTHOUGH FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION ARE BASED UPON WHAT PFD AND THE MANAGEMENT OF THE COMPANY BELIEVE ARE REASONABLE ASSUMPTIONS, THERE CAN BE NO ASSURANCE THAT FORWARD-LOOKING STATEMENTS WILL PROVE TO BE ACCURATE, AS ACTUAL RESULTS AND FUTURE EVENTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN SUCH STATEMENTS.

SUMMARY of TERMS

provides $2.5M to NKC for an 8% preferred equity position and return on capital for its Phase 1 Clinical Trial to achieve its CE Mark.

+

Invested capital is evidenced through a

Stock Purchase Agreement

which converts from Preferred to Common at 100% return of invested capital.

+

Future rights at

20%

discount to market value.

=

is entitled to 100% MOIC plus 8% of the company.

SPONSOR

PFD Capital Partners

Lake Forest, CA 92630

Email:

info@PFDCap.com

Office Phone:

(888) 475-4748

VENDOR

PFD Management LLC

Lake Forest, CA 92630

Email:

team@pfdmanagement.com

Office Phone:

(888) 475-4748

ECONOMICS

Huygens™ Catheter List Price: $1,600

Proteus Robotic Arm™ List Price $125K

Revenue Model:

Huygens™ Catheter

The unit is a one-time consumable. Depending on facility capacity for EP procedures, the need will vary but is a significant source of ongoing revenue for the company.

Proteus Robotic Arm™

The unit is considered to be a one-time purchase for a facility. The unit is targeted both large and small hospitals, surgery centers, and medical schools. Some additional revenue is expected from a value-add service agreement.

Revenue Projection:

Revenue for the system is dependent upon the ability to penetrate the market.

- There are approximately 6000+ EP facilities performing catheter ablation procedures in the US.

- Recent studies show that 75K procedures are done each year and is expected to have continued growth.

- Based on a first-year penetration: to 50 hospitals:

50 Proteus Systems = $6.25M

+ 7000 Huygens Catheters $11,2M =

$17.45M GROSS REVENUE

Future Revenue:

NKC’s conservative estimate for a three-year market is a penetration into an additional 110 hospitals.

110 Additional Proteus Systems = $13.75M

+ 62,625 Additional Huygens Catheters $100.2M =

$131.4M GROSS REVENUE

MEDIA

Huygens™ Catheter Overview

Proteus™ Robotic Arm Overview

Q&A With Josh Shachar and Dr. Jose Merino

in Madrid, Spain.

CGCI Corporate Presentation

Channel 4 Story on CGCI

Installation in Madrid Spain

Magnetecs Q&A With Josh Shachar

and Dr. Jose Merino in Madrid, Spain.

Interview With Dr. Eli Gang

Magnetecs TVE News 2 Interview

CGCI Electrode Targeting.

CGCI Symphony

Magnetecs TVE News 1 Interview