KEY HIGHLIGHTS

- PFD/iOI’s UEC has several key differentiators from its competition.

- These differentiators have been clearly defined and incorporated into the patents.

- A major medical device company has been using a spine cage device that incorporates some of the key differentiators specific to the UEC.

- A clear path between the PFD/iOI device development and the offending company’s device development and use can be demonstrated.

- Because of the above, PFD/iOI believes a Cause of Action for patent infringement is viable.

- PFD/iOI is in process of pursuing this Cause of Action.

- PFD/iOI is seeking monetary judgment or settlement based upon the medical technology company’s time in the market with their device, their sales, and the calculated damages to PFD/iOI’s ability to move forward in the marketplace.

INVESTMENT OVERVIEW

By packaging this startup equity investment within a proven revenue-generating program at PFD Management Opportunity Fund 3001, LLC (PFDMOF3001).

The investor receives:

- 5% annually on invested capital, distributed on a quarterly basis.

- 165% of invested capital back at the end of year 5 ($1.00 gets $1.65 at term)

The internal rate of return is 18% annually

- 5% annually for 5 years is 25%

- 165% at term is an additional 13% annually for 18% IRR

The investor has little else to be concerned with should the exit of this project take longer to exit, or the projected valuation varies from initial projections.

- Upon exit of this portfolio company, the fund will distribute the net proceeds to fund members proportional to their ownership in the fund.

Projected additional equity return:

- The targeted additional return is estimated for a 66% one-time distribution.

The American Society of Anesthesiologists estimates that between 20% to 40% of back surgeries fail and only 30% of second back surgeries are successful.

https://www.asahq.org/madeforthismoment/preparing-for-surgery/procedures/back-surgery/

PRESENTATION

The GOBI™ Spine Cage is the latest iteration of the UEC technology and represents a new innovation in providing maximum relief for lumbar spine patients who have suffered vertebral damage. The design provides a three-dimensional approach to creating a spinal fusion solution that can provide longer-lasting relief with a minimized chance of failure or rejection.

TAKE A LOOK AT THE VIDEO HERE TO SEE HOW THE GOBI™ SYSTEM’S DESIGN WORKS.

PAIN POINT

At that moment, the expanding spine cage family was born.

Overview of the path to the current cause – A Brief History

PFD/iOI has determined that a legal cause can be entered into because of patent infringements by a large publicly traded medical device company to PFD/iOI’s Universally Expanding Cage ™ (UEC) technology. The path from the invention’s beginning to the possible infringement is a two-decade-long story. Here is a brief look at how PFD/iOI has evolved to this point.

Dr. Thomas Grotz

The genesis of the UEC began in 2005 when inventor R. Thomas Grotz, MD, met noted orthopedic surgeon Sigurd Berven, MD. The meeting occurred when Dr. Grotz was invited to attend a lecture at a prestigious French restaurant in the area. The dinner and lecture were scheduled to start at 7:00 pm but due to the patient load that day, Dr. Grotz did not arrive until 8:00 pm. As Dr. Grotz and his wife were walking to the entrance, a tall gentleman wearing a white lab coat came rapidly peddling up to the door on a bicycle. Dr. Grotz with his usual good humor commented to the man as he got off his bike, “Ah, I see you’re late as well.” to which the gentlemen replied, “Yes, and that’s bad because I’m giving the talk.” And so, Dr. Grotz and Dr. Berven met.

Dr. Sigrid Berven

Later that evening, after the lecture, Dr. Grotz shared with Dr. Berven some of his history including how he had earned three Stabilizer for Human Joint patents along with three FDA 510k clearances and had performed the first-in-human studies for the Stabilizers at St. Francis Memorial Hospital. This work set his orthopedic inventions’ commercialization precedent and launched Dr. Grotz on his path to finding ever better orthopedic device technologies to help patients; a passion that continues to this day.

Dr. Grotz further shared that his wife, who was also his office manager, had helped him create his beautiful office in the penthouse suite of a nearby building on Van Ness in San Francisco, California and it was there that he and his staff of ten cared for patients, scheduling more limb reconstructive surgeries than most other SF orthopedic surgeons combined.

Intrigued by this, Dr. Berven asked if he might visit the office sometime to which Dr. Grotz replied, “How about right now?” They proceeded to the office and a conversation ensued that lasted well into the early morning hours. The two discussed many things,

- Dr. Berven was curious about how Dr. Grotz had made it to the top with his San Francisco practice, and his passion for inventing.

- Dr. Grotz was equally curious about how Dr. Berven had become the top spine surgeon at UCSF, which so happened to be Dr. Grotz’s alma mater.

One area of questioning was Dr. Grotz’s curiosity about why Dr. Berven liked spine surgery as it seemed to him that success was minimal as half the patients still had post-operative pain.

Example of a BAK Cage

This is when the conversation turned to how spine patients with disc pathology were treated. Dr. Berven explained how patients with ruptured discs were treated by removing the bad disc and then inserting a metal spacer along with a bone graft to replace the injured area. This technique used what was called a spacer as the BAK cage, which in essence was a metal conduit with external threads. Though sometimes successful, if too small, the cage would move around which minimized the chances of it effecting healing, because it did not fuse into place. Conversely, if the BAC or evolving yet static cage implant were too big, the device could cause nerve or vertebral endplate subsidence. At this point, Dr. Grotz asked what may happen if one could insert something that “gets big” filling the space precisely. Such a device, once implanted, would immediately press against the opposing vertebral endplates, and create a better fit, and a higher potential for proper fusing known as arthrodesis. It is worth noting at this point that with any boney fracture, osteotomy, or fusion when any type of hardware is inserted, either the hardware/bone interface heals, or the operative treatment fails. In essence, the principle is, “No motion, no pain”. Dr. Grotz postulated that holding the bones together with an expanding implant device would lead to a better fusion potential, and therefore no pain. At that moment, the expanding spine cage family was born. A solution that would combine dynamic physics, engineering, and clinical need toward better patient outcomes.

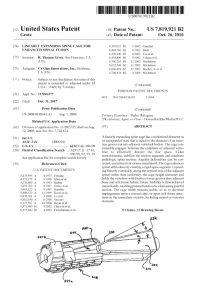

2007 Patent for the LEC

Dr. Grotz spent the next few months with a bright prototype engineer named Rudy Pretti developing and trying out many expansion ideas. These trials included taking the standard BAK cage and cutting it at every other end so that it resembled a Chinese finger trap. It was from this work that the first device, called the Linear Expanding Cage (LEC) was created. The first patent for this expanding spine cage was filed and granted but development beyond this prototype stage was never commercialized. Dr. Grotz and his team, under the banner of his Innvotech Surgical company, then moved toward creating the next generation of a better spine cage. This device was called the Selectively Expanding Spine Cage (SEC) and is built upon a hydraulically controllable mechanism that allowed tiny pistons that when injected with saline during the surgery, would elevate up a circular stairwell allowing the spine cage to expand into a tight fit position. An additional patent on the SEC was filed and granted and after a year of testing, John Barrett, the CEO of Innvotech Surgical, was able to get the attention of Casey McGlynn, Esq., the top patent attorney at Wilson Sonsini, one of the largest law firms in the United States that specialized in business, securities, and intellectual property law patent, to refer the work on the SEC to Alloy Ventures, Inc. Alloy Ventures, Inc, was a venture capital firm that invested primarily in early-stage information technology, cleantech, and life sciences. Alloy was immediately interested and arranged for one of their principals, Doug Kelly, MD, along with John Barrett to go to UCSF to talk with Dr. Berven. During this meeting in surgery, Dr. Berven concurred that the efficacy of the SEC device was merit worthy. Over the next several years, the development of the SEC continued, and the first-in-human trials were done in South Africa, followed by 1000 successful patient surgeries around the world, using the SEC implant. The results of these trials were clinically impressive, and the SEC began to draw the attention of several large players in the orthopedic hardware space. Innvotech Surgical, which held the intellectual property rights for the SEC was renamed CoAlign Innovations and the SEC was rebranded as AccuLif. Medtronics had invested in the R&D. Soon thereafter a deal was negotiated that allowed Stryker Corporation, a multinational medical technology company based in Kalamazoo, Michigan to purchase CoAlign along with all its IP including the AccuLIf cage.

After the sale, Dr. Grotz was invited to discuss in an industry magazine, OrthoKnow, Strategic Insights into the Orthopaedic Industry, what further improvements might be made for an ideal orthopedic spine device to maximally correct and control spinal deformities. In the article, Dr. Grotz discussed the concept of a Universally Expanding Cage (UEC) that could be inserted at any angle and be adjustable to precisely change spine angulations to correct issues such as scoliosis and kyphosis. A provisional UEC patent had been filed. In addition to this article, Dr. Grotz also entered into a conversation with K2M Stryker where he presented several ideas and offered to partner with them. The company however was not interested in pursuing a relationship. Dr. Grotz went ahead and pursued the development of this spine cage with his new company called iOrthopedics, Inc. (iOi). The next-generation development of the SEC was realized, and Dr. Grotz and iOi pursued new IP protections for what they called the Universally Expanding Cage (UEC). A patent was filed and granted that described a spinal arthrodesis implant to manage pathologic anatomy in deformity and scoliosis, wherein a spine cylindrical or rectangular spine cage could expand at either or both ends, axially controlled, for best surgical results within the three-dimensional human construct. It was this advancement of thinking, with the UEC expanding in variable planes to match patients’ needs, that evolved from a simple up or down Acculif disc space arthrodesis implant to a UEC multi-directional fixation device and surgical method, for improving patient outcomes.

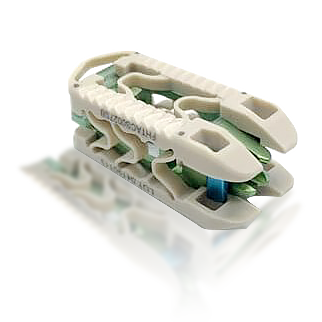

.Dr. Grotz attended an American Academy of Orthopedic Surgeons convention in Las Vegas, Nevada where he saw a spine cage produced by K2M called Mojave which used very similar designs to the UEC. Dr. Grotz built upon his own UEC invention, to create the latest iteration now called Gobi™. iOI began to make plans for its commercialization. In 2018, Stryker purchased K2M and introduced to the market the Mojave technology as the Stryker PL 3D Expandable Interbody System. The device, which had received a 510(k) clearance from the U.S. Food & Drug Administration (FDA) in June 2017, was touted as “The first-of-its-kind fusion device designed to allow for independent control of the anterior and posterior heights in the lumbar spine.” In discussion with reps at the Orthopedic meeting, Dr. Grotz learned that although there was a 510k, no patents had been issued for the Mojave Cage, moving toward the Stryker PL 3D Expandable Interbody System.

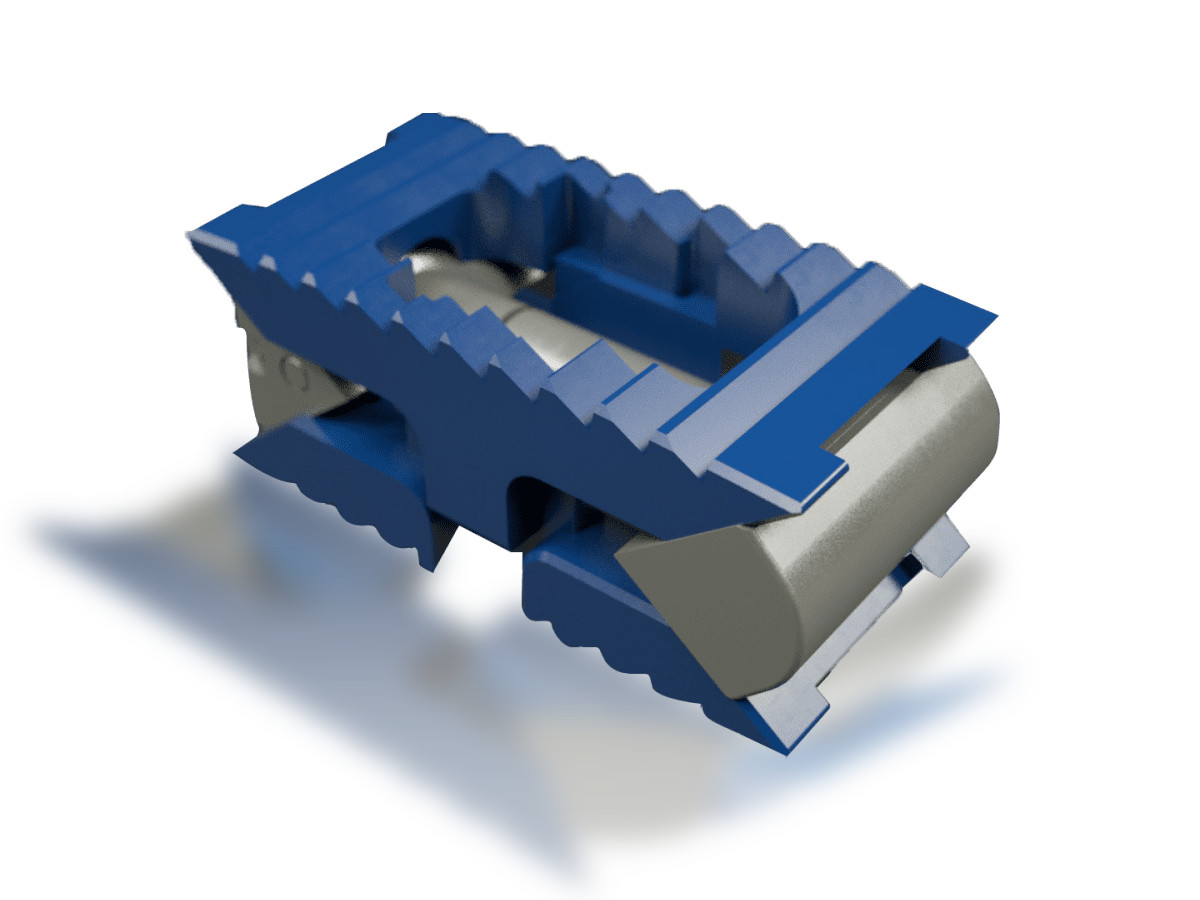

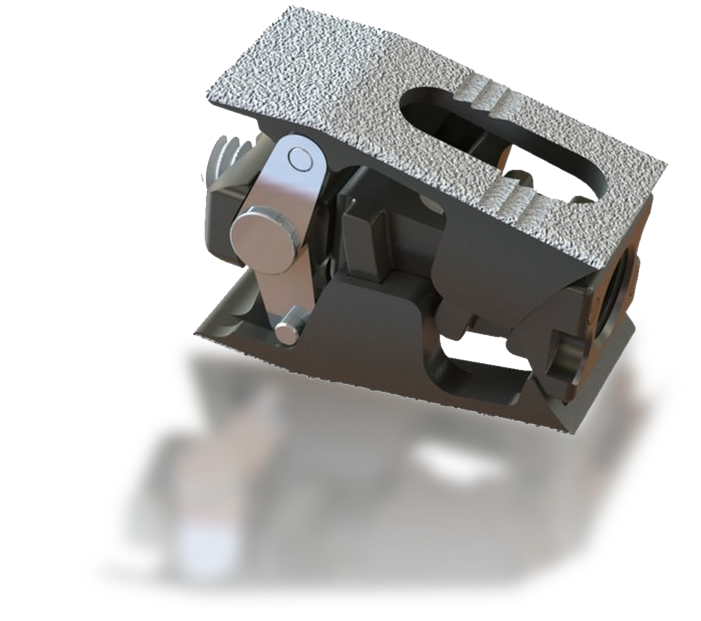

STRYKER’s Mojave spine cage next to the iOrthopedics GOBI™ Spine Cage.

—- Per K2M

“The launch of the MOJAVE PL 3D Expandable Interbody System featuring Lamellar 3D Titanium Technology marks a significant advancement in expandable interbody technology,” said K2M Chairman, President, and CEO Eric Major. “Its infinite adjustment and comprehensive height and lordotic expansion capabilities provide surgeons with a more flexible means to facilitate 3D sagittal balance in their patients. We are proud to reiterate our commitment to excellence in 3D spinal innovation by inventing new solutions, that when supported by our Balance ACS platform, allow spine surgeons worldwide to facilitate quality outcomes in their patients.”

Thus, Dr. Grotz’s ideas, which had been patent pending since 2014, had been commercialized by K2M/Stryker. It was at this point that PFD/iOI began investigating whether K2M/Stryker’s Mojave/PL 3D Expandable Interbody System had constructively utilized the key differentiator of a spine cage applying intervertebral space expansion at either or both ends, controlled by an axial inserter through a proximate wound, in their technology.

PFD/iOI believes there is patent infringement by at least one of the offending company’s devices.

To the extent the PFD/iOI legal team can prove this and show damages, the case will be awarded in our favor. PFD/iOI owns the patents covering the expandable spine cage designs and methods of surgery for the market even beyond the UEC technology and believes it has been damaged for approximately five years by K2M, and the offending company.

PFD/iOI’s intent is to seek recovery of those damages and/or to sell the IP.

ELEVATOR PITCH

- PFD/iOrthopedics (PFD/iOI) owns patents covering a Universally Expanding Cage (UEC) for the orthopedic repair and reconstruction of spine-related issues.

- For this device, PFD/iOI has developed and patented methods of surgery for the UEC technology.

- In addition, PFD/iOI has outlined market uses for the UEC including its first iteration product candidate, the GOBI™ Spine Cage.

- PFD/iOI believes its patented UEC technology has been infringed upon by the offending company’s Mojave PL 3D Expandable Interbody System.

- PFD/iOI believes the damages for this infringement extend from 2014.

- PFD/iOI believes the unauthorized use of iOI UEC Gobi Spine Cage device and method invention patents, thwarted iOI’s spine cage marketplace dominance.

- PFD/iOI has the intent to seek recovery of those damages and/or to sell the IP.

ADDRESSING THE MARKET

- Approximately 500,000 people undergo back surgery each year in the US.1.

- Surgery cost for these operations exceeds $11 billion/year.1.

- Many of these surgeries are to restore function to patients with pain and disability caused by herniated or ruptured spinal discs, and spinal deformity.1.

- Long-lasting success rates for back surgery are very low with one study showing that up to 74% of surgeries fail. 2.

- UEC/GOBI spine technology evolved from decades of work, experience, applied engineering, regulatory conformance, and patent acquisition. It should be honored.

Clearly, the spine market is a very large and growing market. PFD/iOI’s technology development provides an important step forward in meeting this need to provide better patient outcomes by addressing one of the major problems associated with current orthopedic hardware implants, their inability to achieve a precision fit that is stable and able to allow proper fusion and new bone growth to occur.

PFD/iOI was well on the way to bringing this technology to market with its first iteration product candidate, the GOBI™ Spine Cage prior to the discovery of the3 offending company’s technology infringement.

Resolution of this issue has become essential to PFD/iOI’s continued goal to bring the GOBI™ Spine Cage, as well as the future iterations of this technology, to the consumer market.

Once resolved, the PFD/iOI team is intent on selling the technology to the market leaders in the orthopedic spine field of lumbar repair.

Future and secondary markets include the sports medicine field as well as iterations to address variable spine fusion and motion preservation areas.

1. https://consumer.healthday.com/encyclopedia/back-care-6/backache-news-53/back-surgery-645795.html#:~:text=About%20500%2C000%20Americans%20undergo%20surgery,operations%20to%20relieve%20back%20pain.

2. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5913031/

More then $11 billion is spent each year for back surgery in the US.

https://consumer.healthday.com/encyclopedia/back-care-6/backache-news-53/back-surgery-645795.html#:~:text=About%20500%2C000%20Americans%20undergo%20surgery,operations%20to%20relieve%20back%20pain.

INTELLECTUAL PROPERTY

DEVICE PATENTS

PFD/iOI holds eight patents on its implantable spine technology. These patents cover the key differentiators that set their device technology apart from other related spine hardware on the market.

OTHER PATENTS

In addition to the patents held for its implantable spine technology, PFD/iOI holds 15 patents on its other implantable orthopedic device technologies. Combined these patents provide a formidable and secure IP portfolio that sets PFD/iOI in a strong place to be able to compete in the marketplace.

HUMAN IP

PFD/iOI operates from a team of legal and business partners who have vast experience in taking device technology companies from idea to shelf with effective and scalable business strategies. Core to all this is the ongoing efforts of Dr. Thomas Grotz and his team whose innovations continue to push the envelope for better patient cures in the area of orthopedic medicine.

SCALABLE BUSINESS MODEL

ThePFD/iOIUEC implantable orthopedic device technology promises a major leap forward for patients suffering from lumbar-related back issues. It is estimated that of the 500,00 back surgeries performed each year, 40% are for some sort of lumbar fusion correction. 1.

The volume of elective lumbar fusion increased 62.3% (or 32.1% per 100,000 US adults), from 122,679 cases (60.4 per 100,000) in 2004 to 199,140 (79.8 per 100,000) in 2015. Increases were greatest among age 65 or older, increasing 138.7% by volume (73.2% by rate), from 98.3 per 100,000 (95% confidence interval [CI] 97.2, 99.3) in 2004 to 170.3 (95% CI 169.2, 171.5) in 2015.1.Estimates are the this increase trend will conbtinue as the population ages.

PFD/iOI is positioned to meet and scale this need via the following strategies:

-

- PFD/iOI will pursue the current infringement cause to its completion in order to remove the current barriers to the market the issue is causing.

- PFD/iOI continues its development and testing of its first iteration of the UEC, the GOBI™ Spine Cage in order to gather the data to be able to submit to the FDA for the regulatory certifications needed to begin first-in-man studies.

- Once obtained PFD/iOI will institute an independent audit to determine the current valuation of the company and the technology, and if at the desired exit position, will then begin to entertain offers from large medical device companies in the space to sell the UEC IP.

- PFD/iOI will continue its research and development of its implantable orthopedic device technology for other applications from cervical, thoracic, lumbar, and sacroiliac joint (SI) maladies. The focus is on better fusion, less pain, with best adjustable devices. Novel hardware and joint fixation with Stabilizer engineered pedicle and SI expanding fixation advances are also evolving. These implants and surgical methods aim to reduce pain, improve function..

1.https://journals.lww.com/spinejournal/Abstract/2019/03010/Trends_in_Lumbar_Fusion_Procedure_Rates_and.14.aspx#:~:text=Age%2D%20and%20sex%2Dadjusted%20population,a%2073%25%20rate%20increase).

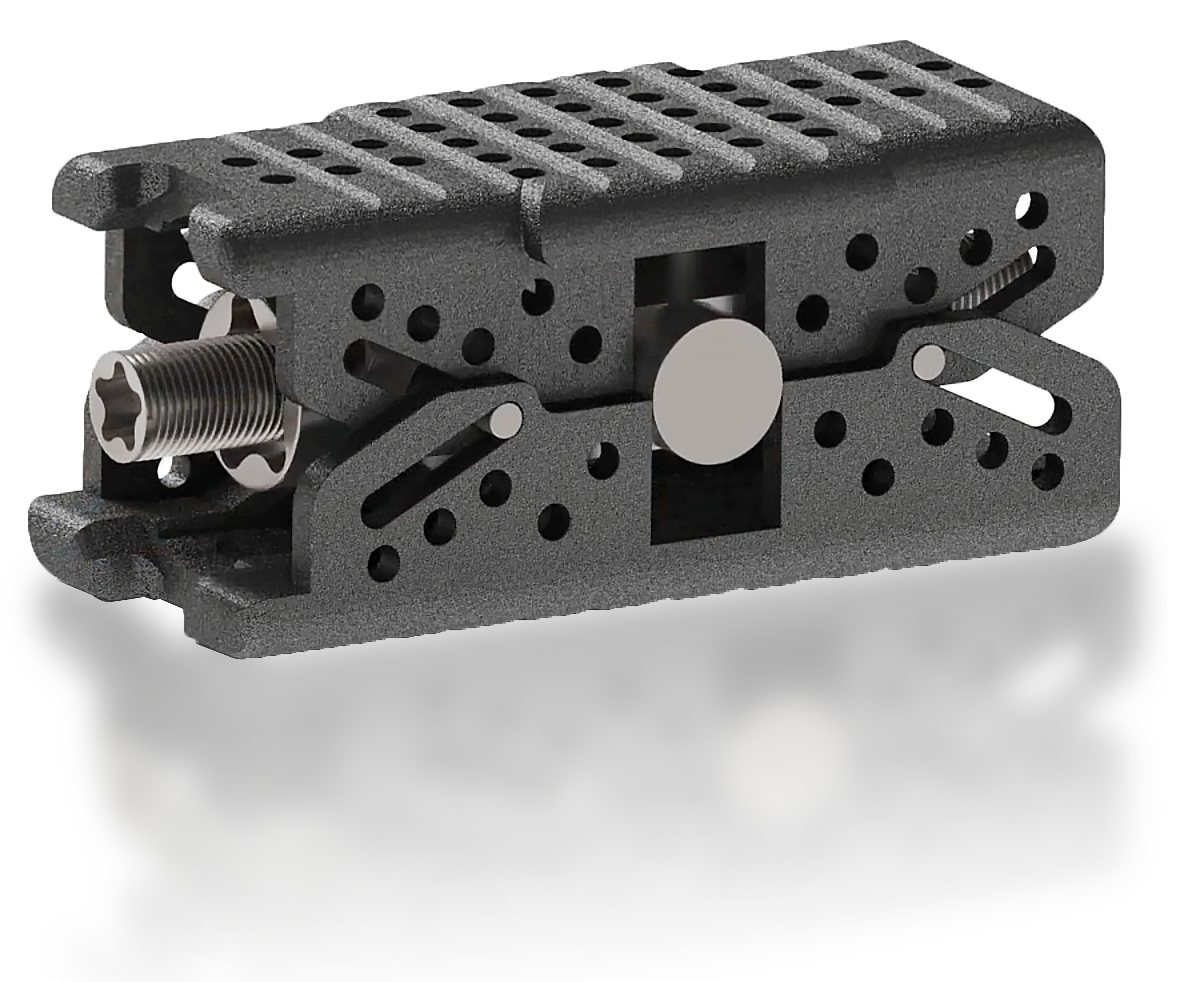

Upper Liftplate

Lower Liftplate

Lower Distal Slot

Lower Proximal Slot

Upper Proximal Slot

Upper Distal Slot

Lifting Screw

Rotational Block

316.L Titanium/Ceramic (FOr newer 3D Printable Material)

COMPETITIVE LANDSCAPE

The medical device hardware market is a highly competitive one with many large global players all vying for market shares. More often than not, the company’s efforts are not at selling a single item product, but rather to negotiate large contracts that cover the medical center to purchase a wide spectrum of their hardware line. The marketing for spine stabilization hardware is no different. The key to gaining entry for a product, and then a product line and hopefully a product category, is dependent upon having unique features, and to a lesser degree, a competitive price point, that sets the device apart from the competition. PFD/iOI‘s UEC technology, and its first product candidate iteration, the GOBI™ Spine Cage is just such a technological advance which is why the infringement cause is both winnable and beyond that, why the technology will be highly sought after by the medical device hardware companies.

Stryker Mojave PL 3D Expandable Interbody System

Globus Altera Spacer

Globus Caliper Spacer

Accelus FlareHawk9

Aegis AccelFix-XL

MiRus IO™ Expandable Lumbar Interbody

SKILLED LEADERSHIP TEAM

The UEC technology and the GOBI™ Spine Cage were created by PFD/iOrthopedics, INC, (PFD/iOI), a Nevada Corporation based in California. Founded in 2017, the company was established to provide a vehicle for the innovative work of founder Dr. Thomas Grotz. Dr. Grotz is a noted orthopedic surgeon whose decades of experience have earned him the respect of many peers and colleagues. As a result of his years of experience in orthopedic knee surgery, Dr. Grotz began work on envisioning a new approach to traditional TKA surgery that would provide patients with better outcomes. Since its inception, the PFD/iOI team has grown to encompass several key individuals who together are bringing the PFD/iOI vision to an eager marketplace.

EXECUTIVE MANAGEMENT TEAM

R. Thomas Grotz, MD

FOUNDER, INVENTOR and CHIEF EXECUTIVE OFFICER

Gary L Ermoian

CHIEF OPERATING OFFICER

Robert Pryke

CHIEF TECHNOLOGY OFFICER and FUND MANAGER

Christopher J. Woodson, MD

CHIEF INVESTIGATOR

Daniel Rastein, MD, MPH

FDA IRB CONSULTANT

Eric Hansen

MEDICAL DIRECTOR

Mitch Graffeo

PATENT ATTORNEY

Advarra Inc.

IRB SPONSOR

FUNDING TEAM

PFD Capital Partners, Inc

PFD Capital Partners, LLC

PFD Management, LLC

RISK FACTORS

The following is not an exhaustive list of risk factors that may impact the PFDMOF3001 and or this particular portfolio company’s ability to fulfill its goals and/or negatively impact stakeholder value.

In evaluating the PFDMOF3001, the Company itself, and the portfolio company described within these pages and its business, one should carefully consider the following risk factors.

Challenges of penetrating the market with new technology:

Businesses that are often under pressure to cut costs are often hesitant at adopting new technologies. There is a chance that the PFD/iOI UEC technology will have a difficult time penetrating a large sales projections.

Market Messaging:

PFD/iOi is not the first mover in the lumbar expandable spine cage market. This fact may prove challenging from a marketing perspective. If PFD/iOi is unable to deliver a clear message to its potential customers of the benefits of its system (e.g. accuracy, time, etc.) it will have a hard time selling the product.

Competition:

The PFD/iOI UEC technology is highly disruptive to a very assertive and lucrative market, therefor the product may be met with much resistance, especially from the current market leaders, all of which are very well-financed and entrenched.

Venture Capital Speculation:

Venture capital is highly speculative and entails significant risk. Due to this, investments should not be made by investors who cannot afford to lose their entire investment. In addition, these types of securities are illiquid, and investors cannot predict when to expect a return on their investments if any. Even an exit event for a company may yield a partial, if any, return on investment. No communications through PFDMOF3001’s website or any other medium should be construed as an investment recommendation. If you have any questions with respect to legal, financial, or tax matters relevant to your interactions with us, you should consult a professional adviser.

Liquidity:

Investments made via our fund are generally illiquid. This means that once you have committed your money it could be difficult for you to exit your investment and get your money back at a time that suits you. There is no secondary market for your investments.

Control:

By making an investment in PFDMOF3001, you acknowledge that you are making a long-term investment. You will not have control over the day-to-day decisions made in relation to a particular investment or the timing of your exit.

Tax Issues:

You must ensure that you are aware of your tax obligations or any related risks that might apply to you as a result of any investment made by you in this fund. We encourage you to consult with appropriately qualified tax professionals regarding your tax circumstances.

Financial Risks:

Companies which are financed through venture capital may not be fully capitalized. The company may need to raise additional significant funds in the future in order to realize its business plan, which may dilute an investor’s holdings. There is no guarantee that the company will be able to secure future funds.

Execution Risk:

A company may be unsuccessful in executing its business plan for a variety of unforeseen factors. Business plans are necessarily based on a series of assumptions, some of which may not materialize as thought. Such factors include but are not limited to unforeseen challenges in research and development, unforeseen delays in securing key partnerships such as manufacturing, distribution, and marketing partners as well as delays in securing sales.

Adverse Economic Conditions:

Unfavorable changes in economic conditions, including inflation, recession, foreign currency fluctuations, political instability, or other changes in economic conditions, may have an impact on the overall investment environment for early-stage venture investments.

Management Risks:

Early-stage companies depend on a small key management team to make critical corporate decisions. Such a team may prove to be unreliable or ill-equipped for long-term corporate leadership or may simply leave for other opportunities.

Technological Risks & Defensibility:

The company’s underlying technology or intellectual property could be rendered obsolete, ineffective, or invalid by competitors or new technological breakthroughs.

Market Risks:

Even profitable companies are vulnerable to numerous external risks such as fluctuations in market trends, which could negatively impact a company’s core technology or assets, especially those companies which target a narrow sector of the market.

Regulatory & Legal Risks:

Changing regulatory and legal environments may have a significant impact on early-stage companies, complicating or outlawing key success factors. Additionally, your investment is not covered by the US FDIC or UK’s FSCS or other regulatory arrangements, nor any other statutory or voluntary compensation scheme.

Geo-Political Risks:

Early-stage companies that operate in unstable geopolitical regions may be vulnerable to events such as civil unrest, war, and sanctions.

DISCLAIMER

FORWARD-LOOKING STATEMENTS

CERTAIN INFORMATION SET FORTH IN THIS SUMMARY CONTAINS “FORWARD-LOOKING INFORMATION” UNDER APPLICABLE SECURITIES LAWS (“FORWARD-LOOKING STATEMENTS”). EXCEPT FOR STATEMENTS OF HISTORICAL FACT, INFORMATION CONTAINED HEREIN CONSTITUTES FORWARD-LOOKING STATEMENTS AND INCLUDES,

BUT IS NOT LIMITED TO, THE (I) PROJECTED PERFORMANCE OF THE COMPANY; (II) COMPLETION OF, AND THE USE OF PROCEEDS FROM, THIS FINANCING; (III) THE EXPECTED DEVELOPMENT OF THE COMPANY’S BUSINESS, PROJECTS, AND PARTNERSHIPS; (IV) EXECUTION OF THE COMPANY’S VISION AND GROWTH STRATEGY, INCLUDING WITH RESPECT TO FUTURE MARKETPLACE ADOPTION, PARTNERSHIP ACTIVITY, AND MARKET GROWTH; (V) SOURCES AND AVAILABILITY OF THIRD-PARTY FINANCING FOR THE COMPANY’S OPERATIONS; (VI) COMPLETION OF THE COMPANY’S ACTIVITIES THAT ARE CURRENTLY UNDERWAY, IN DEVELOPMENT OR OTHERWISE UNDER CONSIDERATION; (VI) RENEWAL OF THE COMPANY’S CURRENT CUSTOMER, MEMBER, PARTNERSHIP AND OTHER MATERIAL AGREEMENTS; AND (VII) FUTURE LIQUIDITY, WORKING CAPITAL, AND CAPITAL REQUIREMENTS. FORWARD-LOOKING STATEMENTS ARE PROVIDED TO ALLOW POTENTIAL INVESTORS THE OPPORTUNITY TO UNDERSTAND PFD’S BELIEFS AND OPINIONS BASED ON THE COMPANY’S BELIEFS AND OPINIONS WITH RESPECT TO THE FUTURE. THESE STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND SHOULD NOT BE RELIED ON IN ANY WAY. SUCH FORWARD-LOOKING STATEMENTS NECESSARILY INVOLVE KNOWN AND UNKNOWN RISKS AND UNCERTAINTIES, WHICH MAY CAUSE ACTUAL PERFORMANCE AND FINANCIAL RESULTS IN FUTURE PERIODS TO DIFFER MATERIALLY FROM ANY PROJECTIONS OF FUTURE PERFORMANCE OR RESULT EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. ALTHOUGH FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION ARE BASED UPON WHAT PFD AND THE MANAGEMENT OF THE COMPANY BELIEVE ARE REASONABLE ASSUMPTIONS, THERE CAN BE NO ASSURANCE THAT FORWARD-LOOKING STATEMENTS WILL PROVE TO BE ACCURATE, AS ACTUAL RESULTS AND FUTURE EVENTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN SUCH STATEMENTS.

SUMMARY of TERMS

Is a 50% equity holder in iOrthopedics, INC

+

-

Is the PFDMF3001, LLC Vendor

-

Is the PFD/iOI Project Manager

-

Financier, Operator, Distributor

+

-

The fund is assigned 50%* of the proceeds from commercialization.

-

The targeted additional yield is projected at 66%

*50% of PFD earnings are 25% of total earnings

=

-

5% annual fixed preferred for 5 years, settlement income 25% ROI

-

Target 165% additional at term

-

Medical Accounts Receivable 18% IRR

-

Plus the equity participation

SPONSOR

PFD Capital Partners

Lake Forest, CA 92630

Email:

info@PFDCap.com

Office Phone:

(888) 475-4748

VENDOR

PFD Management LLC

Lake Forest, CA 92630

Email:

team@pfdmanagement.com

Office Phone:

(888) 475-4748